NOURIEL ROUBINI Unsustainable private-debt problems

LONDON -- The Great Recession of 2008-2009 was triggered by excessive debt accumulation and leverage on the part of households, financial institutions, and even the corporate sector in many advanced economies. While there is much talk about de-leveraging as the crisis wanes, the reality is that private-sector debt ratios have stabilized at very high levels.

By contrast, as a consequence of fiscal stimulus and socialization of part of the private sector's losses, there is now a massive re-leveraging of the public sector. Deficits in excess of 10 percent of GDP can be found in many advanced economies, and debt-to-GDP ratios are expected to rise sharply - in some cases doubling in the next few years.

As Carmen Reinhart and Ken Rogoff's new book "This Time is Different" demonstrates, such balance-sheet crises have historically led to economic recoveries that are slow, anemic, and below-trend for many years. Sovereign-debt problems are another strong possibility, given the massive re-leveraging of the public sector.

In countries that cannot issue debt in their own currency (traditionally emerging-market economies), or that issue debt in their own currency but cannot independently print money (as in the euro zone), unsustainable fiscal deficits often lead to a credit crisis, a sovereign default, or other coercive form of public-debt restructuring.

Read article

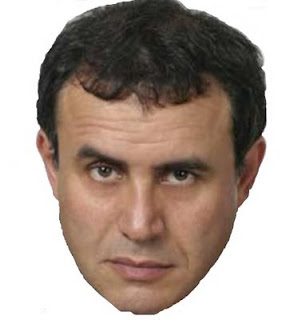

Nouriel Roubini is Professor of Economics at the Stern School of Business, New York University and Chairman of RGE Roubini Global Economics , a global macroeconomic consultancy.